Hey there, folks! If you're reading this, chances are you're diving into the world of home loans and trying to figure out what's up with current mortgage rates. It's a big decision—after all, buying a house is one of the most significant investments you'll ever make. So, buckle up because we're about to break it down for you in a way that's easy to digest and packed with all the info you need.

You might be wondering, "What's the deal with these current mortgage rates anyway?" Well, let me tell you, it's like a rollercoaster ride. Rates can fluctuate based on a bunch of factors, from the economy's mood swings to the Federal Reserve's decisions. And trust me, understanding these rates isn't just about numbers—it's about securing your financial future.

Now, before we dive headfirst into the nitty-gritty, let's set the stage. This article isn't just a random collection of facts; it's your go-to resource for navigating the complex world of mortgages. We'll cover everything from the basics to advanced strategies, ensuring you're armed with the knowledge to make smart decisions. So, let's get started!

Read also:Alexander Skarsgaringrd Height The Real Deal Behind The Nordic Giant

Why Current Mortgage Rates Matter

Alright, let's talk turkey. Why should you care about current mortgage rates? Well, here's the deal: mortgage rates directly impact how much you'll pay for your dream home over the long haul. A small difference in the rate can translate to thousands of dollars over the life of the loan. And who doesn't want to save a few grand, right?

But it's not just about the money. Understanding mortgage rates helps you time your purchase perfectly. Buying when rates are low means more house for your buck, while high rates might mean you need to rethink your budget. It's like playing chess with your finances—strategic moves can lead to big wins.

Factors Influencing Current Mortgage Rates

So, what makes these mortgage rates tick? There's a whole bunch of factors at play. Let's break 'em down:

- Economic Conditions: The economy's doing well? Rates might dip. If it's struggling, rates could rise.

- Federal Reserve Decisions: The Fed's got a lot of power here. When they adjust interest rates, mortgage rates often follow suit.

- Inflation: Rising inflation can push rates up as lenders try to keep up with the cost of living.

- Supply and Demand: More people buying homes? Rates might climb. Fewer buyers? Rates could drop.

See, it's like a big puzzle where all the pieces have to fit just right. And understanding these factors gives you a leg up in the game.

Breaking Down Current Mortgage Rates

Now, let's get into the specifics. What exactly are current mortgage rates, and how do they work? Think of mortgage rates as the price tag on borrowing money. The lower the rate, the less you pay in interest over time. But there's more to it than just a number.

Types of Mortgage Rates

There are different types of mortgage rates, each with its own pros and cons:

Read also:Paul Glaser The Visionary Tech Guru Revolutionizing The Digital Landscape

- Fixed-Rate Mortgages: The rate stays the same throughout the life of the loan. Great for stability!

- Adjustable-Rate Mortgages (ARMs): The rate can change after an initial fixed period. Risky but can save you money if rates drop.

- Jumbo Loans: For those big-ticket homes, these loans often come with higher rates.

Choosing the right type depends on your financial goals and how long you plan to stay in the home. It's like picking the right tool for the job—use the wrong one, and things can get messy.

How to Compare Current Mortgage Rates

Comparing mortgage rates isn't as simple as looking at the numbers. There's more to consider:

- Annual Percentage Rate (APR): This includes the interest rate plus any additional fees, giving you a clearer picture of the total cost.

- Loan Terms: A 15-year mortgage will have higher monthly payments but less interest over time compared to a 30-year loan.

- Lender Reputation: Stick with reputable lenders to avoid hidden fees and scams.

It's like shopping for a car—you don't just look at the sticker price; you check out the features, reliability, and long-term costs. Same goes for mortgages.

Current Mortgage Rates Trends

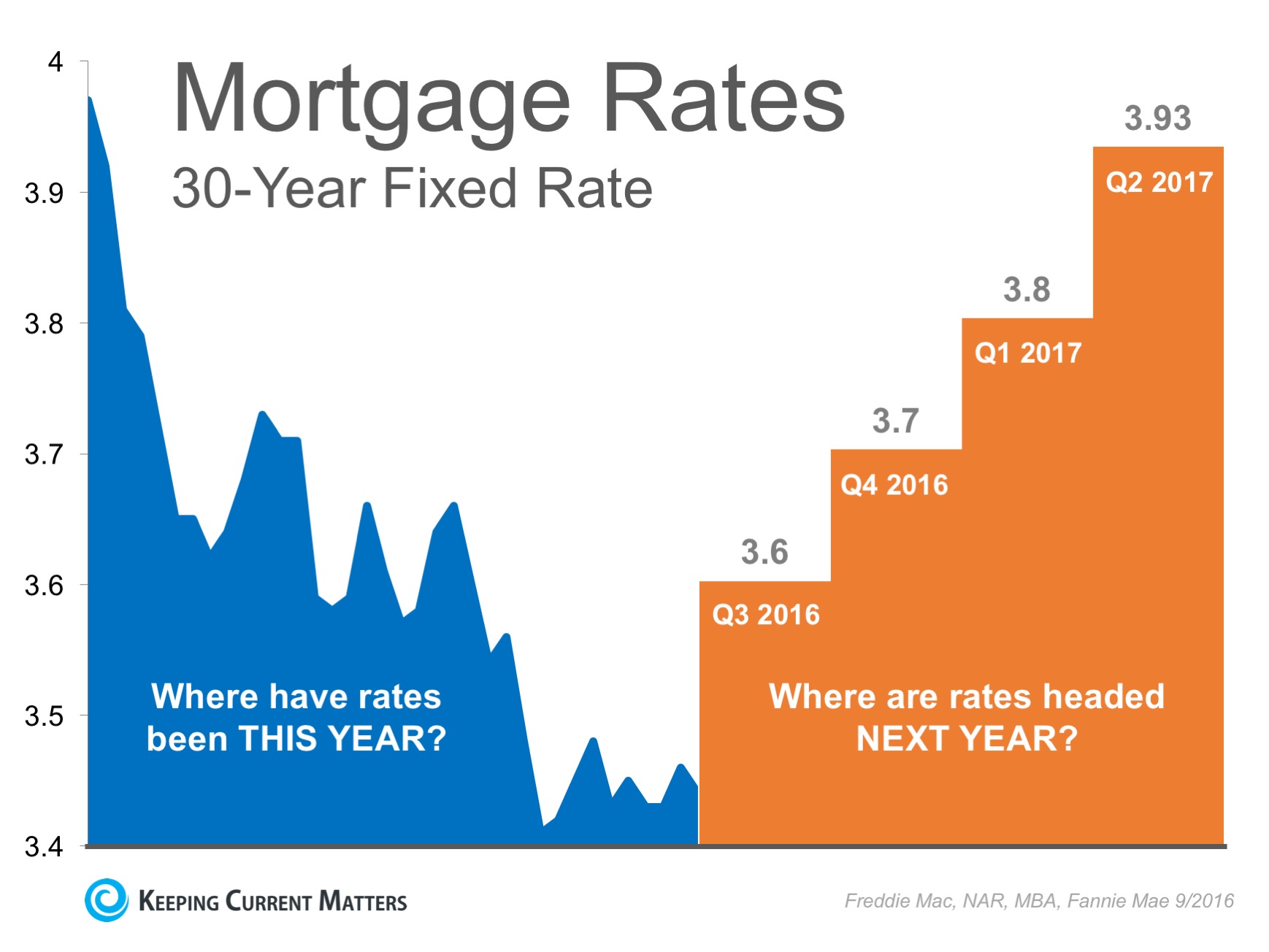

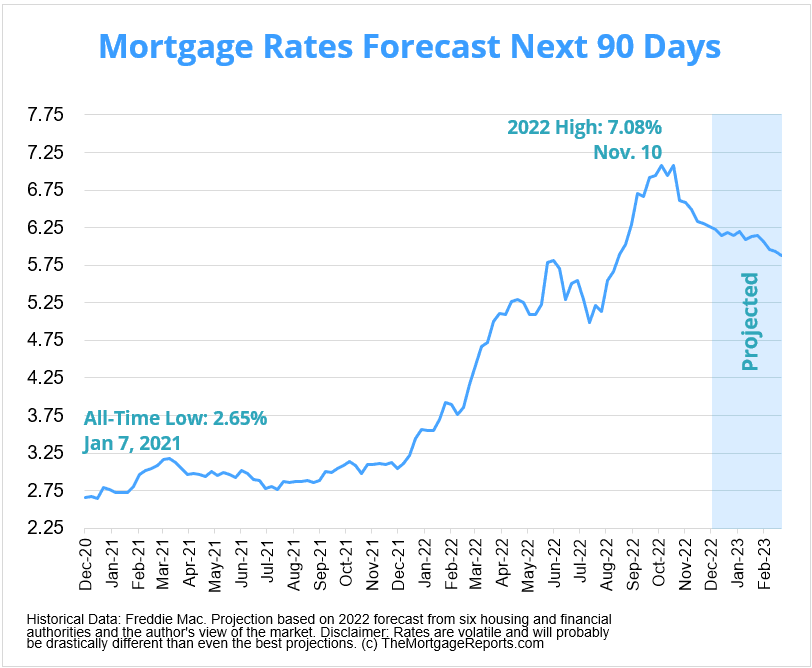

Let's talk trends. As of late, mortgage rates have been on a bit of a seesaw. Historically low rates have been creeping up as the economy recovers from the pandemic. But don't panic—there's still opportunity to snag a good deal if you time it right.

Historical Context

Looking back, mortgage rates were sky-high in the 1980s, averaging around 18%. Compare that to today's rates, which hover around 6-7%, and you can see how far we've come. It's like comparing the price of a loaf of bread back then to now—crazy, right?

Strategies for Securing the Best Current Mortgage Rates

Now, let's get practical. How do you lock in the best rates? Here's the scoop:

- Boost Your Credit Score: Higher scores often mean lower rates. Pay down debt and make payments on time.

- Shop Around: Don't settle for the first offer. Get quotes from multiple lenders to compare.

- Consider a Smaller Down Payment: Some programs offer great rates with lower down payments, so explore your options.

Think of it like negotiating a deal—arm yourself with knowledge and don't be afraid to haggle for the best terms.

Common Mistakes to Avoid

There are a few pitfalls to watch out for:

- Ignoring Fees: Those little extras can add up fast. Always ask for a breakdown.

- Not Locking in a Rate: If you find a great rate, lock it in to protect yourself from fluctuations.

- Believing Hype: Just because someone says a rate is "too good to be true," it might just be a great deal. Do your research!

Mistakes happen, but being informed helps you sidestep them. It's like avoiding potholes on a road trip—pay attention, and you'll have a smoother ride.

Understanding the Impact of Current Mortgage Rates

Finally, let's talk impact. Current mortgage rates don't just affect your wallet; they influence the housing market as a whole. Low rates drive demand, pushing home prices up. High rates can cool things off, making it a buyer's market.

Long-Term Considerations

When you're thinking about current mortgage rates, consider the long game:

- Refinancing: If rates drop significantly after you buy, refinancing could save you big bucks.

- Market Trends: Keep an eye on the market to time your moves perfectly.

It's like chess again—plan your moves, anticipate changes, and you'll come out on top.

Conclusion

Alright, folks, that's the scoop on current mortgage rates. From understanding the factors that influence them to strategies for securing the best deal, you're now equipped with the knowledge to navigate the mortgage market like a pro.

So, what's next? Take action! Whether it's improving your credit score, shopping around for lenders, or timing your purchase, there's no better time than now to start. And don't forget to share this article with your friends—knowledge is power, and helping others is always a good move.

Table of Contents

- Why Current Mortgage Rates Matter

- Factors Influencing Current Mortgage Rates

- Breaking Down Current Mortgage Rates

- How to Compare Current Mortgage Rates

- Current Mortgage Rates Trends

- Strategies for Securing the Best Current Mortgage Rates

- Common Mistakes to Avoid

- Understanding the Impact of Current Mortgage Rates

- Long-Term Considerations

- Conclusion

Remember, buying a home is a big deal, and understanding current mortgage rates is a crucial part of the process. Stay informed, stay strategic, and you'll be well on your way to homeownership success!